Estimated Tax Payments to the IRS: What & Why You Should Pay

What Are Estimated Taxes?

Estimated tax payments are quarterly payments made to the IRS on income that isn’t subject to withholding.

Typically, this includes self-employment income, rental income, interest, dividends, alimony, and gains from the sale of assets.

These payments are crucial for small business owners and individuals with significant non-wage income to avoid penalties.

Meet Luna

Luna is a freelance graphic designer who recently started her own business. Excited about her new venture, she focused on building her client base and delivering quality work.

However, when tax season arrived, luna was hit with an unexpected surprise – a hefty tax bill along with penalties for underpayment. She had not made estimated tax payments throughout the year.

This article will help you avoid Luna’s mistake by explaining estimated tax payments, who needs to pay them, and how to stay compliant with the IRS.

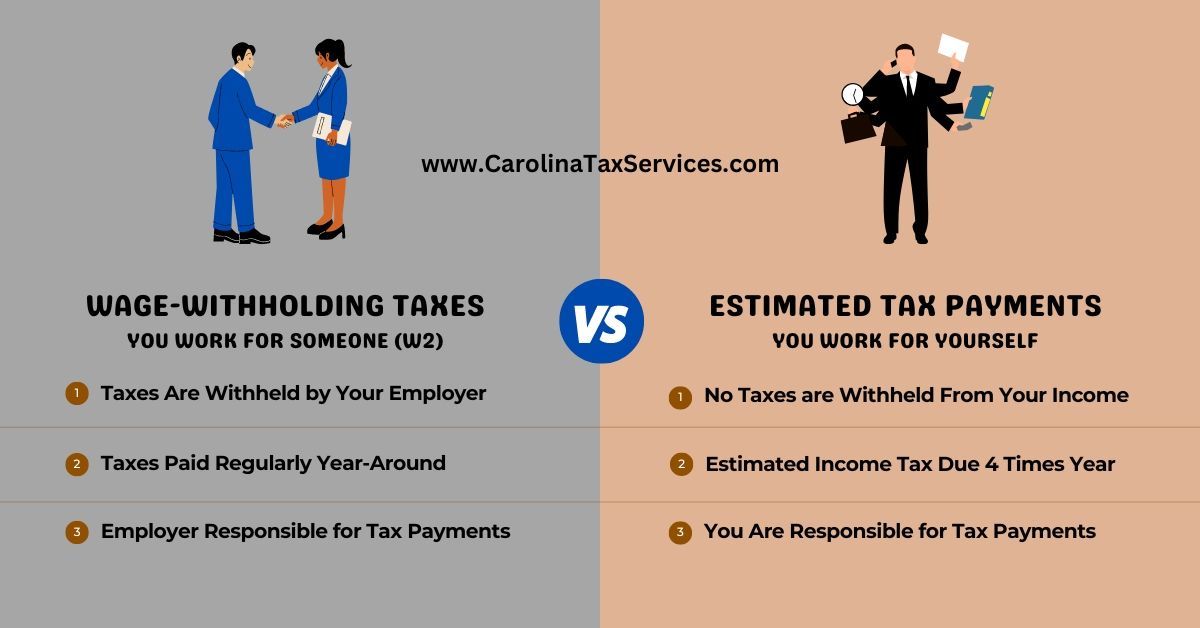

Wage Withholding vs. Estimated Tax Payments

Understanding the difference between wage withholding and estimated tax payments is essential to effectively manage your tax responsibilities.

Wage Withholding Taxes

Wage withholding taxes are automatically deducted from your paycheck by your employer. This system ensures that your taxes are paid regularly throughout the year. Your employer calculates and withholds the appropriate federal, state, and sometimes local taxes from each paycheck based on your W-4 form.

Key Points:

- Automatic Deduction: Taxes are automatically withheld by your employer.

- Consistent Payments: Ensures regular payment of taxes throughout the year.

- Employee Responsibility: Employees must only ensure their W-4 form is accurately filled out to reflect their tax situation.

Estimated Tax Payments

On the other hand, estimated tax payments are made by individuals whose income is not subject to withholding, including self-employed individuals, freelancers, landlords, and investors. These quarterly payments ensure you cover your tax liability as you earn income.

Key Points:

- Self-Managed: Individuals are responsible for calculating and paying their estimated taxes.

- Quarterly Payments: Taxes are paid four times yearly based on estimated income.

- Non-Wage Income: This applies to income not subject to withholding, such as self-employment earnings, rental income, and investment gains.

Who Needs to Pay Estimated Taxes?

Estimated tax payments are required for:

- Self-Employed Individuals: If you own a business, freelance, or contract, you likely need to make estimated tax payments.

- Income Not Subject to Withholding: This includes dividends, interest, rental income, and alimony.

- Significant Additional Income: Consider estimated taxes if you receive substantial additional income not covered by withholding.

Specific Scenarios Requiring Estimated Taxes

- Freelancers and Contractors: Your income isn’t subject to withholding.

- Landlords: Rental income usually requires estimated tax payments.

- Investors: Substantial interest, dividends, or capital gains must be covered.

How to Calculate Estimated Tax Payments

Calculating estimated taxes involves estimating your expected adjusted gross income, taxable income, deductions, and credits for the year.

Here’s a simplified process:

- Estimate Your Income: Include all sources of income.

- Calculate Deductions and Credits: Deduct any expenses or credits you qualify for.

- Use IRS Form 1040-ES: This form includes worksheets to help you calculate your estimated tax.

Tips for Accurate Calculation

- Keep Records: Keep detailed records of all your income and expenses.

- Adjust Quarterly: Re-evaluate your income and deductions quarterly to avoid overpaying or underpaying.

- Consult a Professional:

Tax preparation professionals can help ensure accuracy.

How to Make Estimated Tax Payments

The IRS offers several methods for making estimated tax payments

- Online: Use the IRS Direct Pay or the Electronic Federal Tax Payment System (EFTPS).

- By Mail: Send a check or money order with Form 1040-ES.

Payment Deadlines

Estimated tax payments are due four times each year:

- April 15

- June 15

- September 15

- January 15 (of the following year)

Consequences of Not Paying Estimated Taxes

If you fail to pay estimated taxes, it can lead to several penalties, including:

- Underpayment Penalty: If you don’t pay enough taxes throughout the year.

- Late Payment Penalty: This is for payments not made on time.

- Interest Charges: Accrued on any unpaid taxes.

How to Avoid Penalties

- Pay on Time: Ensure you make payments by the due dates.

- Estimate Accurately: Regularly update your income and deductions.

- Use Safe Harbor Rules: Pay at least 90% of the current year’s or 100% of the previous year’s tax (110% for higher earners).

Should I Pay Estimated Taxes?

Yes, if you have significant income that is not subject to withholding taxes.

It's not only a requirement but also a smart financial move. It helps you manage your tax burden more effectively and avoids unnecessary penalties and interest.

Advantages of Paying Estimated Taxes

- Financial Planning: Helps you budget for taxes throughout the year.

- Penalty Avoidance: Prevents underpayment penalties.

- Peace of Mind: Reduces stress during tax season.

Additional Resources

To enhance your understanding of estimated tax payments and stay confidently compliant with IRS regulations, dive into the following valuable resources:

- IRS Form 1040-ES and Instructions

Access the official IRS form used for calculating and making estimated tax payments. This resource also includes detailed instructions to help you accurately estimate and pay your taxes. - IRS Publication 505 - Tax Withholding and Estimated Tax

This publication provides comprehensive guidance on withholding and estimated taxes, including how to figure your estimated tax, when to pay it, and the consequences of not paying. - IRS Direct Pay

Use this secure service to pay your estimated taxes directly from your bank account without any fees. It's a quick and efficient way to ensure your payments are made on time. - Electronic Federal Tax Payment System (EFTPS)

This free service provided by the U.S. Department of the Treasury allows you to make federal tax payments electronically. It’s ideal for scheduling future payments or paying multiple tax obligations. - IRS Guide: Pay As You Go, So You Won’t Owe

This IRS guide provides detailed information on withholding and estimated taxes, offering strategies to avoid penalties and ensure you're not caught off guard by a large tax bill. - Professional Tax Preparation Services

Carolina Business Services provides tax preparation assistance to individuals and small businesses, including estimated tax payments.

These resources will help you manage the complexities of estimated tax payments more effectively, keeping you informed and compliant throughout the year.

Frequently Asked Questions

Can I pay estimated taxes using my credit card?

The IRS allows credit card payments for estimated taxes through third-party payment processors. Be aware of the processing fees.

What happens if I overpay my estimated taxes?

If you overpay your estimated taxes, the excess amount will be applied to your tax return, potentially resulting in a refund.

Are there state-specific requirements for estimated taxes?

Yes, each state has its requirements for estimated tax payments. Check with your state's tax authority for details, or contact us, and we'll be happy to help.

What if my income fluctuates throughout the year?

You can adjust your estimated tax payments each quarter to more accurately reflect your earnings and avoid penalties.

Disclaimer: This article is for informational purposes only and does not constitute legal, tax, or financial advice. Please consult a qualified professional to address your specific needs and ensure compliance with applicable laws.