Start Your NC LLC: A Step-by-Step Guide

Turn Your Business Dream Into Reality!

North Carolina Limited Liability Company

(LLC): A Breakdown

Forming an LLC in North Carolina is an easy-to-navigate, straightforward process offering business owners, known as members, the critical benefit of limited liability protection. This protection ensures that personal assets, like homes or cars, are generally shielded from business debts and lawsuits, providing a sense of security and peace of mind.

Unlike sole proprietorships or general partnerships, where personal assets are at risk, an LLC separates personal and business responsibilities. This structure is popular among North Carolina entrepreneurs seeking to reduce individual risk while enjoying the flexibility and recognition of a separate legal entity.

Let's walk through the process together, one step at a time.

Key Characteristics of North Carolina LLCs:

The combination of flexible management options, pass-through taxation benefits, and personal asset protection makes LLCs an excellent choice for businesses formed in North Carolina.

- Pass-through taxation: An LLC's profits and losses are 'passed through' to its owners' personal tax returns. This avoids double taxation, in contrast to corporate taxation, where profits are taxed at the corporate level and then again at the individual level.

- Formation: To establish an LLC, you file "Articles of Organization" with the North Carolina Secretary of State (NCSOS).

- Management: The way an LLC is managed depends on its structure. It can be member-managed, where the members handle the day-to-day operations, or manager-managed, where designated individuals oversee the LLC as outlined in a legal agreement called an operating agreement.

Check out NC Secretary of State Details: Launching a North Carolina Business

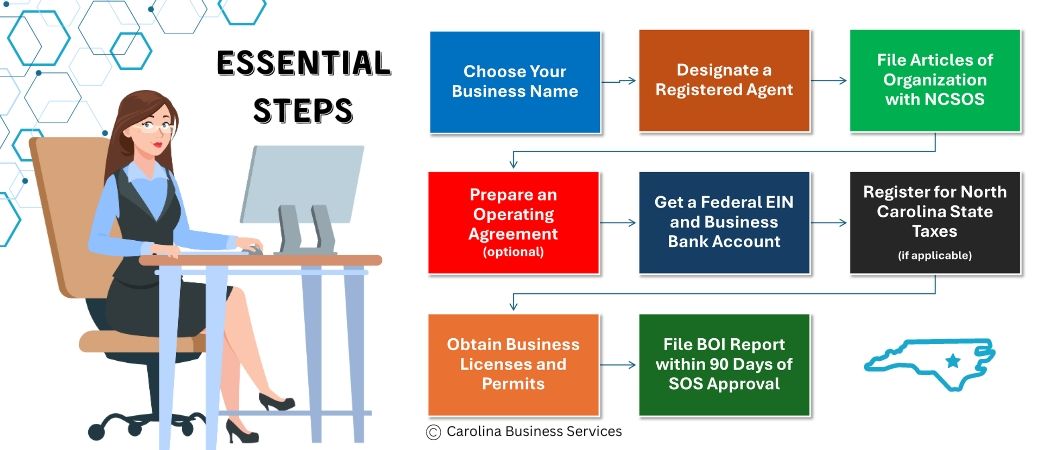

Step-by-Step Guide to Forming Your

North Carolina LLC

Step 1: Unleash Your Creativity and Choose a Standout Name!

Choosing the perfect name for your LLC is your first chance to showcase your brand's personality. It should be catchy, memorable, and accurately reflect what your business does. But don't forget to follow North Carolina's naming rules:

- Uniqueness is Key: Your chosen name cannot be used by any existing LLC or corporation in the state.

- Include the Designation: Your name must include "Limited Liability Company," "LLC," or "L.L.C." or the combination “ltd. Liability Co.” or “ltd. Liability company.”

Pro Tip: Search for Availability and Save Time: Before you get too attached to a name, head over to the North Carolina Secretary of State's Business Name Search tool. This free resource lets you check if your desired name is available, saving you time and frustration down the line.

Step 2: Designate Your Trusted Partner – The Registered Agent

In North Carolina, every LLC must have a registered agent. Think of them as your official point of contact for critical legal documents and business notifications. The agent can be you, a trusted friend or family member residing in North Carolina, or a registered agent service. The designated agent must have an NC physical address.

Pro Tip: Consider a Registered Agent Service for Privacy and Convenience: If you prefer to keep your personal address confidential or simply want a worry-free solution, consider hiring a professional registered agent service. These services offer a reliable address and ensure all legal documents are delivered to you promptly.

Step 3: Make it Official! File Your Articles of Organization

This is where you officially bring your LLC to life! The Articles of Organization act as your LLC's birth certificate, filed with the North Carolina Secretary of State (SOS). Here's what you need to do:

- Complete Form L-01: This form is called the Articles of Organization. You can find it and detailed instructions on the NC SOS website.

- Pay the Filing Fee: The filing fee is $125 and can be paid online or by mail.

- File Online or by Mail: The NC SOS offers a user-friendly online filing system that guides you through the process. Online is faster, allowing you to easily track your submission status. You can also mail your completed form and fee.

Pro Tip: Go Digital for Speed and Convenience: Filing online is highly recommended. It's faster and easier to track. The system guides you through each step. Upon the SOS successful processing of your filing, you'll receive a unique SOSID (Secretary of State Identification) Number – your LLC's official ID in the state.

Need it Faster? Expedited Processing is Available: The standard processing time is 7-10 business days. However, North Carolina offers expedited processing for an additional fee. Choose same-day processing or 24-hour turnaround to get your SOSID number quicker if needed.

Step 4: Solidify Your Partnership (or Solo Act) with an Operating Agreement

An operating agreement is optional, but it's a powerful tool for a smooth-running LLC, whether you have multiple members or operate as a single-member LLC. This document acts as your LLC's internal rulebook, outlining how your business will be managed, member roles (even if it's just you!), and responsibilities. Having an explicit operating agreement from the beginning helps prevent misunderstandings and ensures everyone involved, or you as the sole member, are on the right track.

Think of it as a Compass for Your Venture, No Matter the Crew: Imagine you're launching a dream business. An operating agreement acts like a compass, guiding you through decision-making, financial management, and how the LLC will function. This is valuable for both multi-member LLCs to avoid disagreements and for single-member LLCs to establish clear procedures, especially if you plan to bring on partners or employees later.

Pro Tip: Don't Wait, Create: Drafting your operating agreement early on establishes clear guidelines from the start. This allows you and any potential future members to focus on growing the business without internal disputes. There are many online resources and templates to get you started. However, consulting with an attorney familiar with North Carolina LLC law is always recommended for a customized agreement tailored to your specific structure, whether single-member or multi-member.

Step 5: Secure Your Business Federal EIN – The Tax ID for Your LLC

- It's a free and quick process to apply for an Employer Identification Number (EIN) online.

- An EIN is required for a variety of tasks: opening your business bank account, filing taxes, and hiring employees.

Taxation Choices: Pick the Perfect Fit for Your North Carolina LLC

A significant benefit of forming an LLC in North Carolina is the flexibility in choosing how your business will be taxed. The IRS offers several options for LLCs:

- Sole Proprietorship (Default for Single-Member LLCs): This is the simplest tax structure. All business income and expenses are reported on your personal tax return, Schedule C ("Profit or Loss from Business"). No separate business tax return is required.

- Partnership (Default for Multi-Member LLCs): Each member reports their share of profits and losses on their individual tax returns. The LLC itself doesn't pay income tax, but an informational return using Form 1065 is required. ("US Return of Partnership Income").

- S Corporation: This can be a good option for LLCs where owners want to take a salary and minimize self-employment taxes. To qualify, the IRS requires LLC owners to pay themselves a reasonable salary. Profits beyond this salary are not subject to self-employment taxes.

- C Corporation: This structure is rarely used with LLCs. C-Corps pay income tax on their profits, and owners pay taxes again on any dividends they receive from the corporation.

Pro Tip: Seek Expert Guidance for Tax Optimization: Choosing the best tax structure for your LLC is crucial. Consulting a CPA (Certified Public Accountant) or qualified Tax Professional familiar with North Carolina tax laws is highly recommended. They will analyze your business goals, financial situation, and projected income to recommend your LLC's most tax-efficient structure. They can also advise you on navigating the complexities of each tax filing requirement.

Step 6: Register for North Carolina State Taxes (if applicable)

Once your LLC is up and running, you might need to register for specific state taxes with the North Carolina Department of Revenue (NCDOR), depending on your business activities. Here's a breakdown of the most common state taxes:

- Sales and Use Tax: If you sell tangible goods or certain services in North Carolina, you'll likely need to collect and submit sales tax to the NCDOR. Register for a sales tax permit online and find resources to determine what qualifies as a taxable sale.

- Employer Withholding Tax: If you hire employees, you'll be responsible for withholding income taxes, unemployment insurance, and disability insurance from their paychecks. You must register as an employer with the NCDOR and file appropriate tax returns.

- Other Taxes: Depending on your industry or business activities, you may need to register for additional state taxes, which include franchise taxes, privilege taxes, or specific industry taxes.

Pro Tip: Find the Right Tax Resources:

The North Carolina Department of Revenue website is valuable for understanding and registering for state taxes. They offer comprehensive information, online registration options, and helpful guides.

Explore the NCDOR website

or contact them directly if you're unsure about your specific tax requirements.

Step 7: Navigate Local Licenses and Permits (if applicable)

The final step in ensuring your North Carolina LLC operates smoothly is verifying local licensing and permit requirements. These regulations vary significantly depending on your city, county, and even specific business activity.

Pro Tip: Explore Local Government Resources: Most city and county governments in North Carolina maintain websites with dedicated business resource sections. These sections often provide information on required licenses and permits, with downloadable applications and online filing options where available.

Step 8: File BOI Report

A Brief Overview (Separate from forming your LLC)

BOI stands for Beneficial Ownership Information Report. Approved by Congress, the FinCEN (Financial Crimes Enforcement Network) introduced the Corporate Transparency Act to increase transparency and help combat financial crimes.

What is it? Essentially, businesses must provide the government with information about their owners (beneficial owners). This BOI Report includes details like names, dates of birth, and addresses.

Who needs to report? Most corporations, LLCs, and limited partnerships operating in the US must file a BOI report. Some exceptions exist, such as public companies and companies with more than 20 full-time employees.

When to report? The deadline depends on when you formed your business:

- Businesses formed before January 1, 2024, must report by January 1, 2025.

- Businesses formed after January 1, 2024, have 90 days to report after their formation.

Learn all about Ownership Reporting and how it applies to you.

Summary Checklist:

- Name Game: Pick a unique and compliant LLC name (check availability with the Secretary of State).

- Registered Agent on Deck: Appoint a reliable registered agent with a North Carolina address.

- Operating Agreement (Recommended): Draft an agreement outlining LLC management and operations.

- Articles of Organization: File this official formation document with the Secretary of State.

- EIN Secured: Apply for your Federal Employer Identification Number.

- State Taxes: Register for relevant state taxes with the North Carolina Department of Revenue (if applicable).

- Local Licenses & Permits: Research and acquire any local licenses or permits required for your business activity.

- File the BOI Report: Beneficial Ownership Information

Additional Resources:

- North Carolina Secretary of State: https://www.sosnc.gov/

- North Carolina Department of Revenue: https://www.ncdor.gov/

- North Carolina Small Business Center PDF: Organizing Your Limited Liability Company in North Carolina

- Internal Revenue Service (IRS): https://www.irs.gov/

- Carolina Business Services: Fast, Friendly, and Personalized Tax Preparation Services for Individuals and Small Businesses. https://CarolinaTaxServices.com

Disclaimer: The information in this article is for general informational purposes only and is not intended as legal or tax advice. Individual situations vary, so it is important to consult with qualified professionals to receive advice tailored to your specific circumstances.

NC LLC Frequently Asked Questions

What is an LLC, and why should I form one?

An LLC is a business structure that offers liability protection for its owners. Forming an LLC in North Carolina provides tax benefits. operational flexibility and protects your personal assets from business liabilities.

What if my desired LLC name has already been taken?

Learn MoreUnfortunately, if your desired LLC name is already taken by another business entity registered in North Carolina, you'll need to choose a different name.

The NC Secretary of State's website offers a business name search tool to help you check availability before finalizing your LLC name.

Do I need a registered agent for my North Carolina LLC?

Yes, a registered agent is required. Your agent must be available during regular business hours to receive official documents for your LLC. You can serve as your agent or choose another person or agency.

Can I change my registered agent?

Learn MoreYou can change your registered agent at any point - file Form LLC-122 with the North Carolina Secretary of State. There's also a required fee associated with this filing.

You can find the latest form, filing fee, and instructions on the Secretary of State website:

What is an LLC Operating Agreement?

It is a legal document outlining the rules and regulations of your LLC. While not mandatory in North Carolina, it's highly recommended to protect your business interests.

Do I need a lawyer to form an LLC in North Carolina?

While not strictly required, having an attorney is recommended, especially for complex business structures or if you have specific legal concerns. Many online formation services offer legal document templates and guidance.

How much does it cost to form an LLC in North Carolina?

The 2024 cost associated with forming an LLC in North Carolina is the $125 filing fee for the Articles of Organization submitted to the Secretary of State (expedited approval is extra).

There might be additional costs depending on your specific situation, such as fees for hiring a registered agent service, professional legal or accounting services, and any necessary business licenses or permits.

Are there annual filing requirements for North Carolina LLCs?

An annual report to the Secretary of State by April 15th each year is required. A new LLC must file its first report the following April.

As of 2024, a $203 filing fee is required for online submissions or $200 for paper filings. Failure to file can result in penalties or dissolution of the LLC.

Taxing Times

Get In Touch

About Carolina Business Services

For over 40 years, our firm has been a trusted provider of income tax preparation services to individuals and small businesses across Spindale, Rutherfordton, and Forest City, NC. Our vast expertise and knowledge allow us to handle tax preparations - from simple to complex - across all 50 states and for US citizens living abroad.

Our personalized and efficient tax preparation services are designed with you in mind, and our friendly and fast approach means you can count on us to work for you.

So why wait?

Contact us today!

Centrally Located

Rutherford County, North Carolina

Copyright © 2023 Carolina Business Services - All Rights Reserved.